In January of each year, the Chairmen of the Communes' Councils remind all those who are obliged and liable to pay the tax on undeveloped urban land that the tax declaration and payment must be submitted to the tax authorities.

Owners of undeveloped urban land (TNB) are required to file a declaration and pay the tax before March 1, 2024 in order to avoid the late payment penalties provided for by law no. 07.20 dated December 31, 2020 amending and supplementing law no. 47.06 on local authority taxation.

This tax is applied to land within the urban jurisdiction. Declarations must be made on a form to be obtained from the tax office before March 1.

What land is subject to tax on undeveloped land (TNB)? What are the exemptions from the tax on undeveloped land (TNB)? How is the tax on undeveloped land (TNB) calculated? We tell you all about it in this article.

What is the tax on undeveloped land (TNB)?

This is a direct tax levied on urban communes to combat land speculation and boost the supply of land for construction. Under law no. 07.20 of December 31, 2020, amending and supplementing law no. 47.06 on local authority taxation, this tax is payable on undeveloped urban land located within :

- Urban perimeters established in accordance with the provisions of law no. 131-12;

- Delimited centers designated by regulation;

- Summer, winter and spa talions, the taxing perimeter of which is defined by regulation;

- Areas not listed above and covered by a development plan.

This tax also applies to land attached to buildings whose surface area is more than five (5) times the covered surface area of the buildings as a whole.

It is payable by the owner and, in the absence of a known owner, by the possessor. In the event of joint ownership, the tax is assessed in the name of the joint owner, unless the joint owners request that the tax be assessed separately, in proportion to their known shares. However, each co-owner remains jointly and severally liable for payment of the entire tax.

What are the exemptions from the tax on undeveloped land (TNB)?

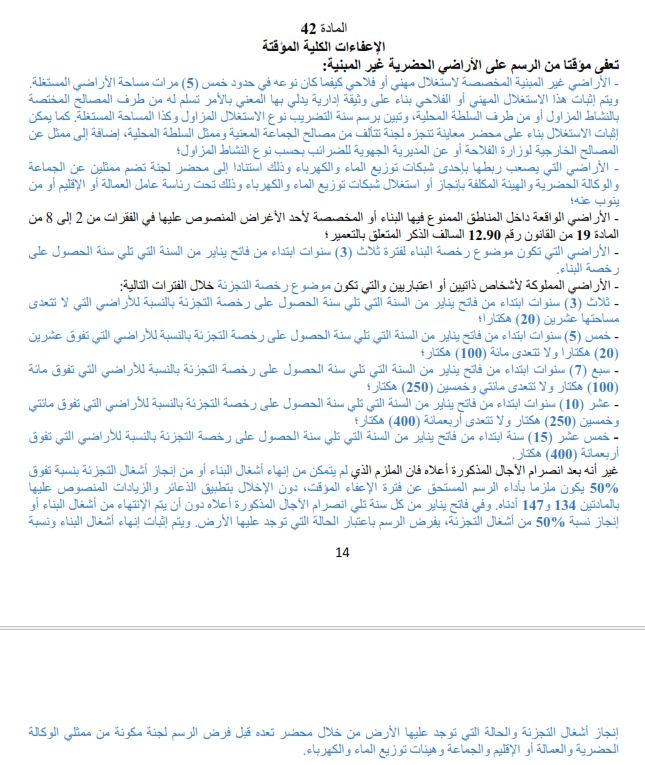

Under articles 41 and 42 of law no. 07.20 dated December 31, 2020, amending and supplementing law no. 47.06 on local authority taxation , there are two types of exemption, either permanent or temporary.

If you are a private individual, here are the cases you need to know about to take advantage of the exemption. According to the same article, the following are temporarily exempt from the tax on undeveloped urban land:

- plots of land located in areas where there is no water or electricity supply network, on presentation of an administrative document attesting to the non-existence of one of these networks, issued by the administration or body responsible for building or operating these networks;

- land located in areas where construction is prohibited or where one of the following uses is permitted:

- Zones in which construction is prohibited;

- The limits of the roadway (lanes, squares, parking lots) to be preserved, modified or created;

- The boundaries of public green spaces (wooded areas, parks, gardens), playgrounds and various open spaces such as areas for cultural and folk events, to be preserved, modified or created.

- The boundaries of areas intended for sports activities to be created in accordance with the provisions of article 61 of law no. 06-87 on physical education and sports promulgated by dahir no. 1-88-172 of 13 chaoual 1409 (May 19, 1989), and the boundaries of the same areas to be retained or modified.

- Sites reserved for public facilities such as railways and their outbuildings, health, cultural and educational facilities, administrative buildings, mosques and cemeteries;

- Sites reserved for public facilities and installations of general interest, such as shopping centers and leisure centers, which are the responsibility of the private sector;

- Districts, monuments, historical or archaeological sites, sites and natural areas such as public or private green zones to be protected or enhanced for aesthetic, historical or cultural reasons, and any rules applicable to them;

Is my land exempt?

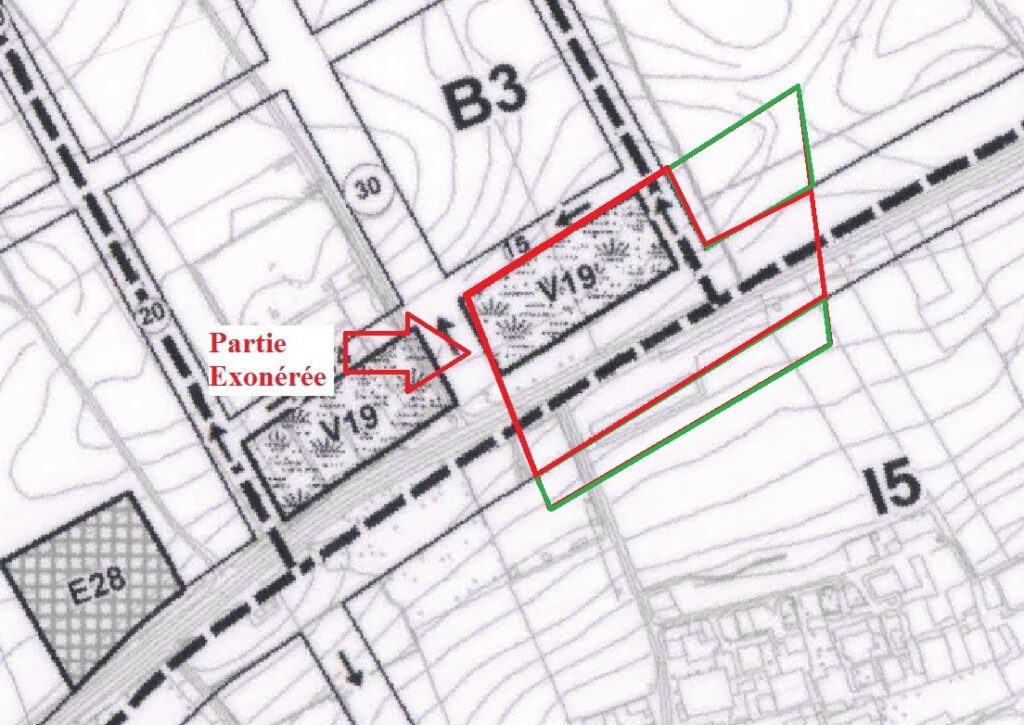

The first step in finding out whether your land qualifies for partial or total exemption from TNB is to check the zoning of your land on the planning documents (see the article Plan d'aménagement : Comment connaître le zonage de mon terrain au Maroc ? " It's Free!") or by requesting the information note.

Your plot's position on the development plan is always appended to the information note as follows:

Next, you can see that in our case, the land is hit by a development road and a green space, so the taxable part is only the green part in the figure below.

But how do you know the exact surface area of the taxable portion?

For an accurate assessment of your property's taxable area, our topographic firm is at your service. We produce a detailed plan and certificate, in line with the standards required by local authorities, using key information such as the information note, layout plan, cadastral documents, and a topographical survey if necessary.

The certificate we provide is crucial in reducing the property tax payable. It is recognized and accepted by local authorities as official proof, enabling a clear distinction to be made between tax-exempt and taxable areas. So, with these documents in hand, you can optimize your tax situation, paying only what's due, without excess.

If you have any questions or would like to receive a certificate and a personalized plan, please don't hesitate to contact us. Send us a message via WhatsApp by clicking on the chat bubble on the right. Our team of experts is ready to assist you to ensure that your topographic needs are meticulously addressed, with the aim of helping you achieve significant savings on your property taxes.

How much do I have to pay for the tax on undeveloped land (TNB)?

According to article 45 law 47-06 includes the latest amendments stipulated by law 07.20 of December 31, 2020. The rates of tax on undeveloped urban land are set as follows:

- building zone from............................................................................ 4 to 20 dh/m;

- villa zones, individual housing zones and other zones from................ 2 to 12 dh/m

Fees of less than one hundred (200) dirhams are neither issued nor paid.

Rates vary from one commune to another according to a tax decree.

The taxpayer must declare and pay the tax before the first of March each year.

Otherwise :

a penalty of 10% and a surcharge of 5% for the first month of delay and 0.50% for each additional month or fraction of a month.

To discover:

Title Your Melk Land in Morocco in 2023: Follow these 7 Essential Steps!

Land dispute mediation: 7 ways our firm can solve your problems in Morocco

What developers don't want you to know: Hidden defects in Moroccan apartments in 2023

Buying property in Morocco as a foreigner: 5 essential tips for success!

5 Risks of Buying Land in Marrakech: Protect Your Real Estate Interests in 2023

Land consultancy in Morocco in 2023: How an engineering firm can help you manage your land legacy

In 2023: How can an engineering firm help you with your real estate projects in Morocco?

Buying untitled property (Melkia) in Morocco in 2023: what are the risks?

Building in rural Morocco in 2023: New simplification of authorizations!

Building plans and permits in Morocco: Where to find them if lost?

TNB before March 01, 2023: Is my land exempt from the tax?

"4 fatal mistakes to avoid when buying land to invest in Morocco!

Estimate the selling price of my apartment, villa or land in Morocco (6 Questions)

How to divide land in Morocco (Part 1)

Land registry in Morocco: How much does it cost to reconcile (update) the land title?

Development plan: How can I find out the zoning of my plot of land in Morocco? "It's Free!"

How to avoid the risks of 2 fatal building layout errors?

How to split title to land in Morocco (Part 1: Co-ownership)

Laying out a villa: 5 things you need to know!

The surveyor's contract: a necessity for both parties

Merging 2 land titles into a single title?

Topographical engineer fees: how much does a service cost? (3 Questions)

The boundary markers on my property have disappeared (5 most frequently asked questions)

Need a topographical surveyor to support and advise you? Then welcome to HEXAGON GEOSURVEYS for your topographic plans, land delimitation, plot division, house layout or architectural survey.

Would you like an appointment, a quote or advice? Write to us and we'll be happy to advise you: (+212) 6 60 41 02 18 Monday to Friday.

Hello

I bought land for equipment in 2016, I am MRE and I do not know from which year I must pay the TNB.

It's an obstacle course for us MREs.

Merci de votre réponse.

I built a house during this period, do I have to pay TNB?

My father died almost 2 years ago and left a plot of land in a free housing estate in the dal hoceima region. The taxes and fees for this plot of land have not been paid for 17 years. so how can I plan for the taxes and fees? ....

Etc

My father died almost 2 years ago and left a plot of land in a free housing estate in the dal hoceima region. The taxes and fees for this plot of land have not been paid for 17 years. so how can I plan for the taxes and fees? ....

Etc

I don't see the link to pay the TNB

THANK YOU

I'm the owner of a plot of land, and because of the change from zone c3s to c4s in the new development plan, I no longer have the right to build. On March 1, I filed the T.N.B declaration. How can I obtain the certificate of exemption?